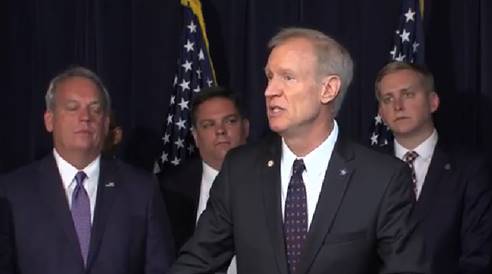

Rauner Says Budget Was Only Possible Thanks to Donald Trump’s Policies

Yesterday, Governor Bruce Rauner signed a full-year budget for the first time since he was inaugurated in 2015 and went out of his way to praise President Donald Trump’s policies for helping make it happen. Asked why a budget happened this year and not in his first three years, Rauner offered one theory when he said Illinois was “fortunate” to receive “unexpectedly high-income tax revenues now, largely thanks to federal changes” that “allowed us to get this budget negotiation done.”

Rauner pointed out that Trump’s tax bill “eliminated many deductions” that helped because the state “ties our tax code to the federal tax code.” In fact, the loss of deductions would hit Illinois particularly hard – housing prices around Chicago were expected drop by 10% in some counties, and, in the end, the bottom 60% of Illinois taxpayers would see their taxes rise while the wealthiest get a tax cut. It would hit Illinoisans even more as changes to the health care system mean insurance premiums would rise 19% for a 40-year old Illinoisan.

“Bruce Rauner is so desperate to get re-elected he is now going out of his way to praise President Trump’s destructive policies,” said DGA Illinois Communications Director Sam Salustro. “Forcing the state through a two-year budget impasse that led to ballooning debt and slashed services left Rauner with rock-bottom approval ratings, and now he’s tying himself to the only politician as unpopular as him – Donald Trump.”

###

Background:

REPORTER: “Governor why do you suppose you couldn’t do this the first three years [inaudible]?”

RAUNER: “The first year and every year I’ve proposed significant cuts that were necessary, there was not agreement on the cuts to balance the budget. This year we were able to agree because we had two fortunate occurrences, agreements. First, we were able to agree on a bipartisan basis to some significant pension reform that we weren’t able to agree with on the past, eliminating spiking, getting cost of living adjustment buy-outs agreed to and other adjustments in the pensions – it saved almost half a billion dollars a year. That was, that allowed us to move this budget forward, I applaud the general assembly for that on a bipartisan basis. The other issue that allowed us to get this budget done was the fact that we are fortunate, we are receiving unexpectedly high-income tax revenues now, largely thanks to federal changes. The regulatory relief for businesses is allowing more economic growth in Illinois and around the country than some of us anticipated. And also, the new tax overhaul that was put through in Congress actually closed many deductions, eliminated many deductions, and Illinois ties our tax code to the federal tax code. That has generated significant new tax revenues that were not planned for. And that’s very significant. That allowed us to get this budget negotiation done. Many other states are actually reducing their taxes as a result of the unexpected increase, and obviously the federal government reduced rates. I hope – I was not able to persuade the General Assembly to reduce taxes this year. We’re actually spending those savings in this budget, and we don’t have debt paydown or tax reductions. Those are two ways that this budget is not what I would like to see, and I think frankly what the people of Illinois need to see. But it’s a compromise and it moves that state forward.”