Can you donate now to join our fight?

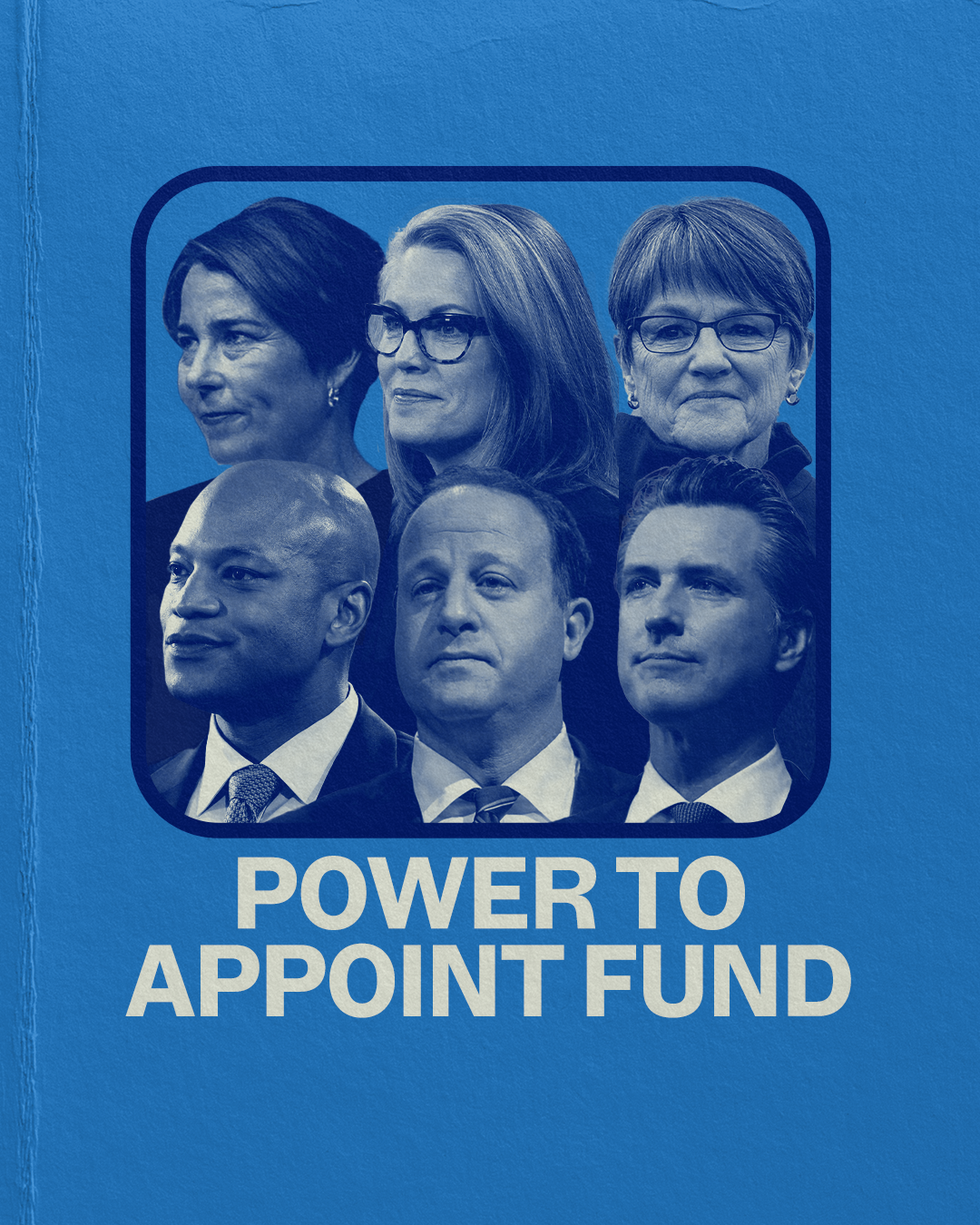

We just launched the Power to Appoint Fund to highlight the important role Dem Govs play to ensure integrity in our country’s judicial process and protect fundamental freedoms. Your support will ensure we can make crucial investments in key states and protect our democracy. Please don’t wait: rush your gift to elect Democratic governors! >>>

NEW TV AD: Snyder's Policies Work For The Wealthy, Not For Everyone

The Democratic Governors Association today released a new television ad, “Online,” in which Democratic gubernatorial candidate Mark Schauer explains how Governor Rick Snyder’s economic policies have worked for the wealthiest, but not for middle-class families. The DGA also launched a new website to accompany the ad, OurMichiganEconomy.com, which details how Snyder cut education funding by a billion dollars and provided tax breaks to companies, even if they shipped jobs overseas.

Watch the ad here: http://youtu.be/LMPZpOwXXJs

Visit the new website: OurMichiganEconomy.com

“Mark Schauer understands that a strong Michigan economy requires investing in education, high-tech research, and good jobs that support families,” said DGA Communications Director Danny Kanner. “Governor Snyder just doesn’t get that – his policies have rewarded the wealthiest and companies that ship jobs overseas while punishing students, seniors, and middle-class families. Michigan needs policies that work for everyone, not just the very wealthy.”

“Online” is the 4th spot that the DGA has run in Michigan. The organization plans to invest significantly in the state.

Here’s the backup for the ad:

| AUDIO AND VIDEO | BACKUP |

| Video: Mark Schauer in manufacturing setting speaking to camera. Camera pulls back (digitally) to reveal that Mark is a video playing on a website that says “Make Michigan’s Economy Work For The Middle Class”. Audio: [Mark Schauer to camera] “I’m Mark Schauer, and there’s a lot we can do to make Michigan’s economy better. |

|

| Video: Pull back to reveal the computer screen is in an elementary school computer lab full of students. Mark gestures to the students on “come from a good education.” Text on screen: 1. Reverse Rick Snyder’s Education Cuts Audio: First, we can reverse Governor Snyder’s billion dollars in education cuts – a good job comes from a good education. |

Snyder Cut Over a $1 Billion from Education:

|

| Video: Cut to a computer sitting on a desk in the middle of an empty factory – Mark is speaking on the computer screen, gestures to empty factory on “even if they send jobs overseas.” Text on Screen: 2. Stop rewarding companies that outsource Audio: Rick Snyder gave tax breaks to businesses, even if they send jobs overseas. We should stop rewarding companies that outsource. |

Gave Huge Tax Breaks to Businesses. “Gov. Rick Snyder signed the biggest tax overhaul in Michigan in 17 years that finances the elimination of the Michigan business tax with a bundle of changes to the personal income tax. Overall, it amounts to a $220 million net cut in tax revenues to state coffers, but for Michigan businesses, including some 100,000 that no longer will have to pay the repealed Michigan Business Tax, it’s a $1.65 billion cut. The difference is being made up with $1.42 billion in additional income taxes, which includes applying the tax to pensions and other retirement income.” [Bridge Magazine, 5/25/11] Department of Labor Concluded Steelcase Inc. in Grand Rapids Shifted Jobs Overseas. “Section 222(a)(1) has been met because a significant number or proportion of the workers in Steelcase, Inc., Grand Rapids, Michigan and Steelcase, Inc., Kentwood, Michigan have become totally or partially separated, or are threatened to become totally or partially separated. Section 222(a)(2)(B) has been met because the workers’ firm has shifted to a foreign country both the supply of services and the production of articles like or directly competitive with the services supplied and the articles produced by the subject workers which contributed importantly to worker group separations at Steelcase, Inc., Grand Rapids, Michigan and Kentwood, Michigan. Conclusion After careful review of the facts obtained in the investigation, I determine that workers of Steelcase, Inc., Grand Rapids, Michigan (TA-W-82,320) and Steelcase, Inc., Kentwood, Michigan (TA-W-82,320A), who are engaged in activities related to the supply of office furniture services and/or the production of office furniture (as the case may be), meet the worker group certification criteria under Section 222(a) of the Act, 19 U.S.C. § 2272(a). In accordance with Section 223 of the Act, 19 U.S.C. § 2273, I make the following certification:” [Department of Labor Trade Adjustment Assistance Database, Steelcase, Inc. Determination, #82340, accessed 1/17/14] Steelcase’s CEO Was a Member of Business Leaders for Michigan, Which Pushed for the Elimination of the Michigan Business Tax. Steelcase’s president and CEO, James P. Hacket was a member of Business Leaders for Michigan when the group pushed for the elimination of the Michigan Business Tax. “After achieving about half of its initial goals, including the repeal of the Michigan Business Tax, Business Leaders for Michigan sees now as the right time to broaden its agenda with ideas that are much more private-sector driven and require a private-public partnership approach.” [Michigan Business Leaders, Members, accessed 1/17/14; MiBiz, 2/10/12] |

| Video: Cut a worker carrying an iPad through a high-tech manufacturing facility/research facility – Mark is on the iPad. Text on Screen: 3. Invest in high-tech research Audio: And start investing in high-tech research to attract new jobs to Michigan. |

|

| Video: Push in tight on Mark for ending. Show web URL on screen. Text on Screen: Rick Snyder’s Economic Policies Aren’t Working For The Middle Class Audio: Tell Governor Snyder … his economic policies work for the wealthy, but not the rest of Michigan.” |

“No foul on billboards chiding Gov. Snyder for higher taxes.” “Democratic gubernatorial candidate Mark Schauer, a former congressman, has made attacks on Snyder’s tax record a centerpiece of his campaign. In 2011, Snyder pushed through sweeping changes to Michigan’s business tax system, scrapping the Michigan Business Tax and replacing it with a 6 percent corporate income tax. It was calculated to be a $1.7 billion business tax cut in 2012-2013 in analysis by the nonpartisan Michigan House Fiscal Agency. To replace much of that revenue, Snyder backed legislation that raised taxes on individuals by about $1.4 billion. Its chief components and their calculated impact in 2012-2013:

|

###