Can you donate now to join our fight?

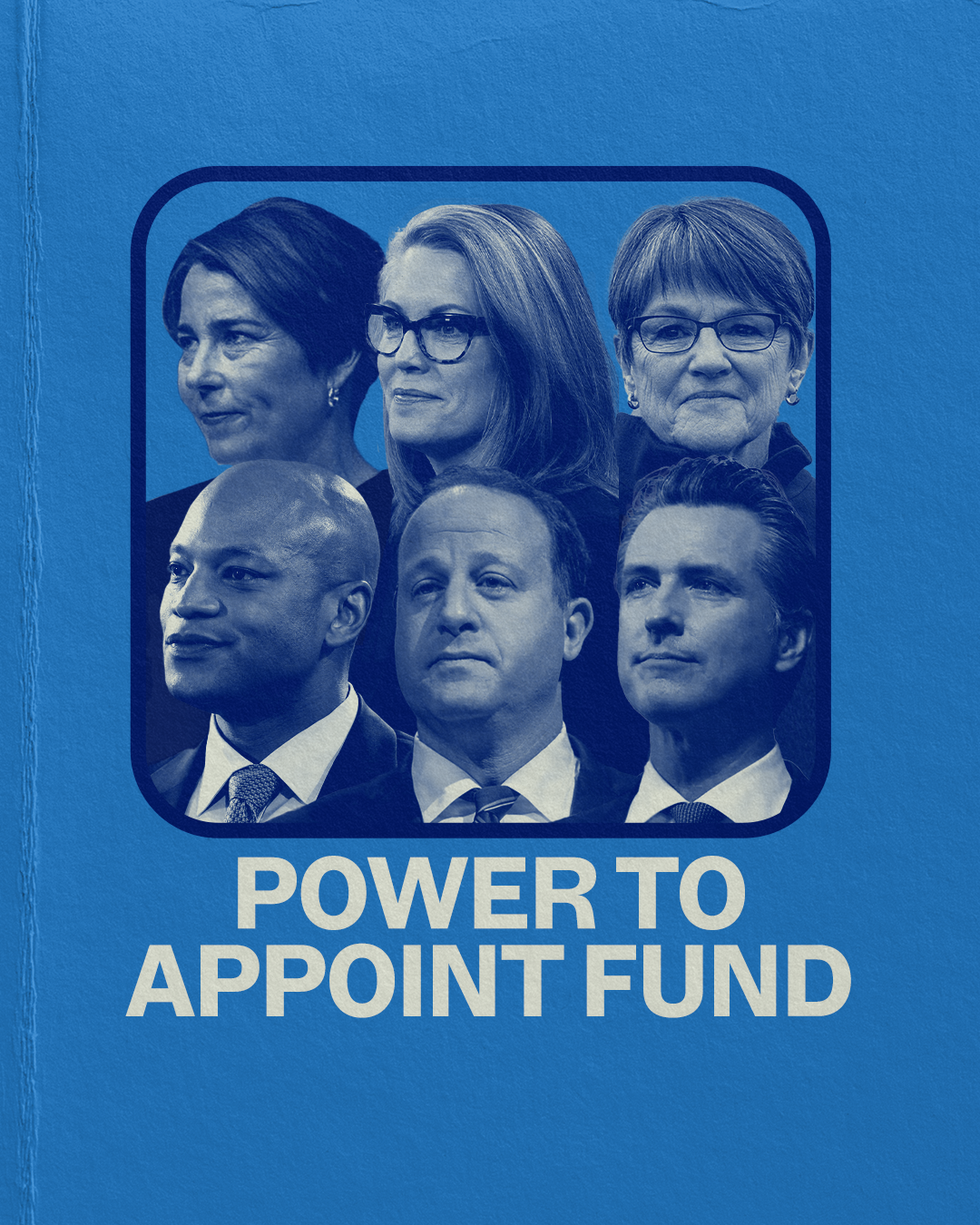

We just launched the Power to Appoint Fund to highlight the important role Dem Govs play to ensure integrity in our country’s judicial process and protect fundamental freedoms. Your support will ensure we can make crucial investments in key states and protect our democracy. Please don’t wait: rush your gift to elect Democratic governors! >>>

Bob Stefanowski Comes Face to Face with His Own Record

Bob Stefanowski Comes Face to Face with His Own Record

CT Post investigation reveals ‘a big gap between this first-time political candidate’s public statements and his businesses practices’

In case you missed it, the Connecticut Post took a closer look at Bob Stefanowski’s business record and how it matches up with his campaign persona. The results weren’t pretty.

It seems like Bob the Candidate and Bob the Businessman are two very different people.

Bob the Candidate admires Donald Trump’s reckless business tactic of reneging on deals with companies that do business with government. Bob the Businessman profited from the recession, taking millions of dollars from Connecticut taxpayers–and still cut 2,000 jobs. While Connecticut was suffering under the economic collapse in 2008, Stefanowski bragged “it’s a big opportunity for us.”

The hypocrisy doesn’t stop there.

Read more about how Bob’s the Businessman’s record doesn’t match with Bob the Candidate’s statements below:

A look at Bob Stefanowski’s business record

Bob Stefanowski proposes steep cuts in government spending and a sharp roll-back in personal and corporate taxes. He opposes highway tolls to pay for transit improvements, calling them an added tax on Connecticut’s citizenry.

But there’s a big gap between this first-time political candidate’s public statements and his businesses practices over the last 10 years, a Hearst Connecticut Media investigation has found.

At his last job, Stefanowski, now the Republican candidate for governor, was paid millions of dollars as chief executive officer of a payday loan company whose short-term interest rates are so high, it is not even allowed to do business in Connecticut.

While chairman of a private-equity group, Stefanowski invested more than $100 million with a company that constructs and profits from operating toll roads.

When he was chief financial officer for UBS, which once touted the largest trading floor in the country at its Stamford office, the bank took $20 million in state support, but by 2017 had laid off more than two thirds of a Connecticut workforce that once exceeded 4,400. …

Read more here.